This may embrace asking for business references, understanding their fee accounts receivable period practices with other suppliers, and even conducting a credit verify. Having this information upfront might help you assess potential risks and make informed decisions about credit terms. The gross sales terms you set together with your prospects will decide when you should obtain payments. This includes defining the credit period (e.g., Net 30, Internet 60), specifying any early payment reductions or late payment penalties, and outlining any other necessary details. A written agreement signed by both parties might help keep away from any future misunderstandings.

This, in turn, permits them to meet short-term obligations, spend money on strategic initiatives, and navigate fluctuations in the financial panorama. The accounts receivable collection period holds paramount significance in the financial management of companies, playing a pivotal function in their cash flow, liquidity, and general monetary health. Your aim is for clients to spend much less time in accounts receivable and extra time paying payments promptly.

What Are Accounts Receivable Days

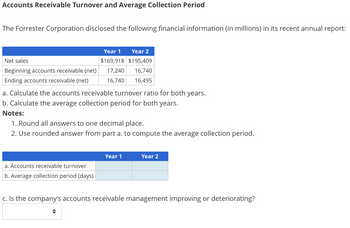

Conversely, a lower ratio may sign assortment points or lenient credit score policies. The common accounts receivable method is straightforward and helps companies understand the entire amount owed to them over a particular period. Effectivity in collecting receivables not only impacts your cash move but in addition has a direct influence in your liquidity. Liquidity refers to your company’s capacity to satisfy short-term obligations and pay its debts in a timely manner. The sooner you acquire payments, the better your liquidity position becomes. On the flip aspect, a prolonged assortment period can tie up your working capital and hinder your ability to settle financial obligations promptly.

The Means To Enhance Common Assortment Interval

It also offers actionable insights for improving your collections process if the period is longer than desired. Additionally, the average assortment period is an important indicator of short-term liquidity, giving you a clearer image of your business’s capacity to manage its resources effectively. It’s a metric that investors and stakeholders usually analyze when evaluating enterprise valuation and operational efficiency. For instance, to calculate DSO for Q1 2024, run a stability sheet as of Jan. 1, 2024, to find the beginning accounts receivable balance. On the opposite hand, a 36.5-day common assortment interval underneath a 15-day cost coverage implies that you may not be amassing as efficiently as you should.

Ready To Streamline Your Fee Operations?

Both way, any cash generated from gross sales to customers, by the business, performs a significant function within the long-term stability and success of a business. Not only does it exemplify the flexibility https://www.kelleysbookkeeping.com/ of the business to generate sales but also demonstrate that the enterprise can generate cash flows from its operations. This result tells you that, on common, it takes simply over 30 days to collect customer payments. Understanding this figure helps you gauge the effectiveness of your present credit score and collections insurance policies. In the fiscal 12 months ended December 31, 2017, there have been $100,000 gross credit gross sales and returns of $10,000.

- On the opposite hand, a longer interval could indicate delays in buyer payments, which may pressure your capacity to fulfill financial obligations or spend cash on development opportunities.

- Additionally often known as invoice factoring, it is a transaction the place a enterprise sells its accounts receivable to a 3rd get together (the factor) at a reduction to get immediate cash circulate.

- This agility in money flow management is essential for assembly day-to-day operational expenses and capitalising on growth opportunities.

- As technology advances, companies can leverage digital solutions to streamline their collection processes and enhance buyer experiences.

A fast collection period may not always be useful because it simply may imply that the company has strict fee guidelines in place. Firms should also contemplate leveraging money assortment know-how to streamline their assortment processes. Implementing an environment friendly and automatic invoicing system can improve accuracy and timeliness while decreasing guide errors. Additionally, utilising online fee platforms and providing a quantity of cost options can facilitate quicker and smoother transactions, decreasing the collection period.

Procurement Energy Play: Streamlining Prices And Control For Enterprise Growth

If the company’s fee terms are 60 days, this collection interval falls inside the acceptable vary. Nonetheless, if the company needs to cut back the gathering period, it could implement some of the strategies mentioned earlier to enhance its money circulate. If the collection period is simply too long, it might indicate that the corporate is extending credit score to prospects who’re slow in paying or that the credit score phrases have to be tightened.